Fraud

FraudMay 15, 2024

Number Spoofing: What You Need to Know

Number Spoofing: What You Need to Know

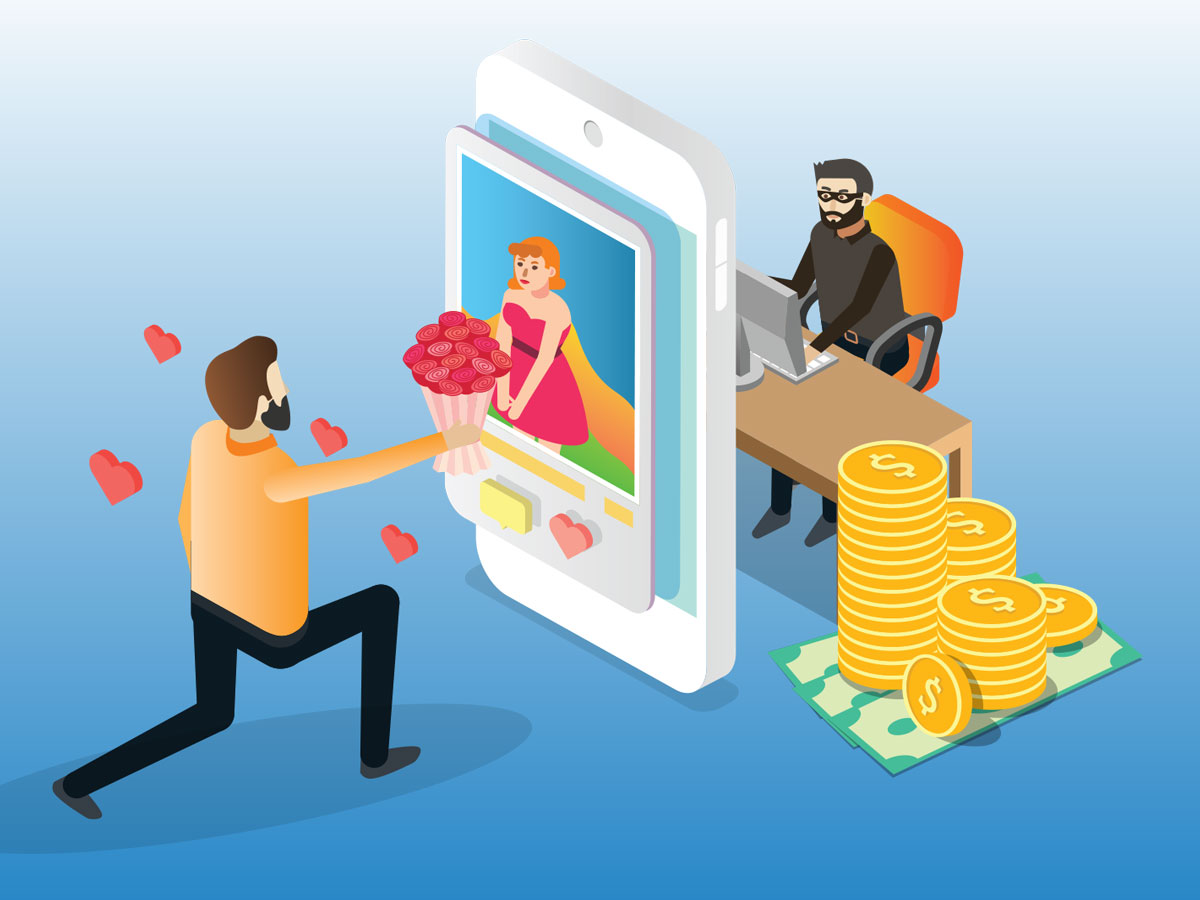

Phone scams and phishing attempts are increasingly more common and more sophisticated. But they still share the same end goal of trying to scam consumers out of their hard-earned money. With these scams on the rise, and the people behind them using more advanced technologies, it is important that consumers stay educated and alert when it comes to giving out any personal information. Below, we’ve compiled a list of some of the most common phone scams and what you need to know to protect yourself.

One Ring Scam

Have you recently received a phone call where you don’t recognize the number, and after one ring, the call ends? This is what is known as the One Ring Scam. The scammer is hoping that you will be curious enough to call the number back. The number goes to an international toll number and will appear as a charge on your phone bill with most of the money going back to the person that initiated the scam. Be alert and do not call this number back. Instead you should report it to the FTC at www.donotcall.gov/ and to the FCC at www.fcc.gov/complaints. As an extra precaution, you should always check your phone bill for any suspicious or unusual charges.

Spoofed Phone Numbers

Number spoofing is being used more and more frequently. This is when you receive a phone call or text that looks like it’s coming from your bank, a doctor’s office, your employer, etc. The scammers will disguise their phone number and send you messages or calls trying to alert you of potential fraudulent charges on your account. They’ll request that you confirm your account numbers and PINs or other personal information that will help them gain access to your accounts.

When such a text or call comes through, never give your personal information, even if the number looks familiar. Always call your financial institution, employer, or doctor back directly using the number that you know is legitimate. They can confirm whether or not there are suspicious charges to your accounts.

IRS Scams

Be wary of this scam as the IRS noted that summertime tends to be a favored time period for these types of calls. Tax payers have recently filed their returns and may be awaiting a response from the IRS. These calls start with the scammer claiming to be the IRS and threatening people over supposed debts. Callers typically will threaten things such as arrest, deportation and license revocation if the recipient doesn’t pay a bogus tax bill. The IRS will never demand immediate payment and will never require a specified payment method like prepaid debit cards, gift cards, or wire transfers. Typically, the IRS will mail a payment notification rather than trying to reach the taxpayer on the phone.

Overall, if you find yourself on the receiving end of a phone scam and someone asks you for personal information, account information, or password, you should hang up immediately and report the call. Additionally, if someone calls and is seeking a specific payment type – such as wire transfer, prepaid debit card, or gift card – they are most likely not a real agency. When it comes to guarding your personal information and protecting yourself against phone scams, it is important to keep informed and exercise caution.